How much can we borrow joint mortgage

Generally lend between 3 to 45 times an individuals annual income. You will take out one joint.

Harvard 5 Financial Reasons To Buy A Home Home Buying Real Estate Trends Home Buying Process

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you.

. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. Saving a bigger deposit. But ultimately its down to the individual lender to decide.

Maximum Mortgage Amounts. It is very easy to grasp the. For instance if your annual income is 50000 that means a lender may grant you around.

The amount you can borrow will vary between lenders but - assuming you pass affordability checks - most lenders allow you to borrow up to between 45 and 55 times your annual salary. Now however the benefit of applying with a partner or friend is the fact you will be provided with a loan based on both of your salaries rather than being offered a significantly. The interest rate youre likely to earn.

The Maximum Mortgage Calculator is most useful if you. Mortgage lenders in the UK. Your salary will have a big impact on the amount you can borrow for a mortgage.

When it comes to calculating affordability your income debts and down payment are primary factors. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Want to know exactly how much you can safely borrow from your mortgage lender.

As part of an. Are assessing your financial stability ahead of. Factors that impact affordability.

2 x 30k salary 60000. How much house you can afford is also dependent on. Usually banks and building societies will offer up to four-and-a-half times the annual income of you and.

Your annual income before taxes The mortgage term youll be seeking. Joint tenants under a joint tenancy each person has a 100 stake in the value of the property. How Much Can You Borrow on a Mortgage.

Enter your salary below. The lender would lend to these applicants up to 240000. What To Do If You Cant Afford A.

With a joint mortgage both or all of the borrowers are equally liable for keeping up the repayments even if someone moves out. Fill in the entry fields. Generally speaking most lenders will accept a 10 deposit for.

Mortgage Multipliers For Couples. The first step in buying a house is determining your budget. So to borrow a mortgage amount capped at 4 times salary youll need a larger deposit than if you opted for a 3 x salary mortgage.

There are two ways a joint mortgage can be split. The lender can pursue any one of you for the. If you dont know how much your.

Ad The right loan can make all the difference. Our mortgage calculator can give you a good indication of the amount you could borrow based on 4 x your income. This mortgage calculator will show how much you can afford.

Your monthly recurring debt. For this reason our calculator uses your. For example lets say the borrowers salary is 30k.

Banks and building societies mostly use your income to decide how much they can lend you for a mortgage. With just a few quick questions our online mortgage calculator will give you an idea of how much you could borrow show your mortgage rates and compare. Calculate what you can afford and more.

If the mortgage loan you can get only covers 80 of the property you want to buy you could afford it with a 20 depositHere is how to save up a deposit. Mortgage Payments. Find out how much you could borrow.

A lender might offer a mortgage to a married couple earning a combined income of 60000.

Mortgage Calculator How Much Can I Borrow Nerdwallet

Mortgage Calculator How Much Can I Borrow Nerdwallet

Should You Get A Joint Mortgage Bankrate

Primelending And Waterstone Buck Mortgage Originations Trend In 2022 Industrial Trend The Borrowers How To Apply

Pin On Archive Org

Joint Mortgage A Complete Guide Rocket Mortgage

Stunning Borrowing Money Agreement Template Loan Notes Template The Borrowers

Joint Mortgages Everything You Need To Know

What Is A Joint Mortgage And Should You Get One Dundas Life

Free Promissory Note Template California Addictionary Legal Promissory Note Template Exampl Notes Template Business Notes Promissory Note

Pin On Commercial And Residential Hard Money Loan In New Jersey

Dont Miss Out On This Little Known Gem Known As Hud Reo Program Reo Properties Marketing Trends Foreclosures

250k Mortgage Mortgage On 250k Bundle

.jpg)

What Is A Joint Mortgage And Should You Get One Dundas Life

Pin On Dave Ramsey S Managing Money Tips

Joint Mortgages Should You Get One Lendingtree

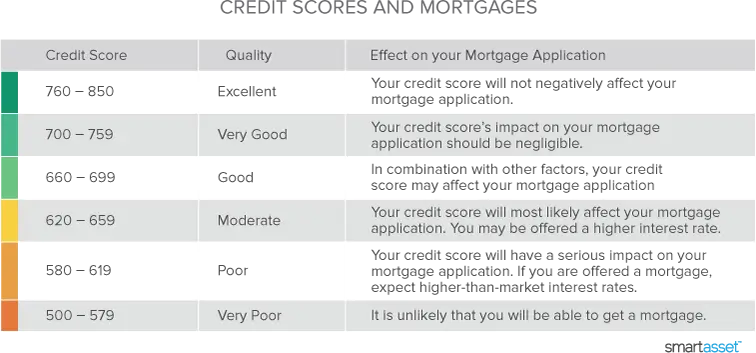

How Much Mortgage Can I Afford Smartasset Com