Determining cost basis for rental property

Second you calculate the adjusted cost basis of your property. The basis for the gain is your purchase price 170000.

/HOWMONEYISMADEREALESTATEFINALJPEG-8db8883c13df4233ba2aad6ae392647f.jpg)

How To Make Money In Real Estate

You can determine the land value and the cost basis for your rental property in several ways.

. Using Tax Assessments to Calculate Cost Basis. Assuming that you had bought the property for. State stamp taxes or other.

The basis is used to calculate your gain or loss for tax purposes. What is the cost basis for a rental property. However reporting it in TurboTax isnt particularly easy.

How is step up basis in rental property calculated. You may also have to capitalize add to basis certain other costs related to buying or producing the property. Regarding basis for depreciation on rental property.

IRS rules indicate to take the purchase price of the property and depreciate over 27 12 years adjusted for any personal use. The original cost basis of a rental property is the purchase price plus. The simplest way to calculate.

Almost no closing costs incurred on a sale of a residence are. 1 Use the date of death as your step up date. Generally property received as a gift are calculated with respect to the original owners.

Use your basis to figure depreciation amortization. 2 Get real estate appraisals for your rentals based on date of death. 703 Basis of Assets.

If your sale price is. Original cost basis for a rental property. The basis of property you buy is usually its cost.

In most cases the sale of Rental Property is sold in the rental. Adjusted cost basis for a rental. Calculate gain on sale of rental property.

Agreed upon purchase price of the property. The cost basis of the investment is 10000 but it is more often expressed in terms of a per. First its important to know that basis is the amount of your capital investment in a property and is used for tax purposes.

The Internal Revenue Service IRS. First you need to capture the following costs in your property basis. You can also add your closing costs.

To find the adjusted basis. You can adjust the cost basis now. The basis is the purchase price plus related realtor commissions.

Broker or realtor commissions. June 6 2019 1112 AM. You can calculate the tax basis of a rental.

If you sold the property for 600000 your gain will be 163000 600000 amount realized minus 437000 adjusted basis. 1 Best answer. A simple formula for calculating adjusted cost basis is Adjusted Cost Basis Purchase price Depreciation Improvements.

The basis is also called the cost basis. The Internal Revenue Service IRS defines the tax basis of a rental property as the lower of fair market value or the adjusted basis of the property. Start with the original investment in the.

Basis is generally the amount of your capital investment in property for tax purposes. Your original basis in property. The basis of a rental property is the value of the property that is used to calculate your depreciation deduction on your federal income taxes.

Lets say that you purchase a property as a. Regarding basis for depreciation on rental property. 3 Determine if your state.

Depreciation For Rental Property How To Calculate

Depreciation For Rental Property How To Calculate

Pin On Rental Property Investment

The One Percent Rule Quick Math For Positive Cash Flow Rental Properties

Rental Property Depreciation Rules Schedule Recapture

How To Create A Rental Property Management Application From Scratch Part 1 Free Download Youtube

Rental Property Depreciation Rules Schedule Recapture

Converting A Residence To Rental Property

X194mrrdy2zf1m

Renting Vs Owning Home Rent Vs Buy Being A Landlord Mortgage

Property Management Income And Expenses Buildium

Short Term Buy Hold The Buy 3 Sell 2 Keep 1 Plan Real Estate Investing Rental Property Real Estate Tips Real Estate Investing

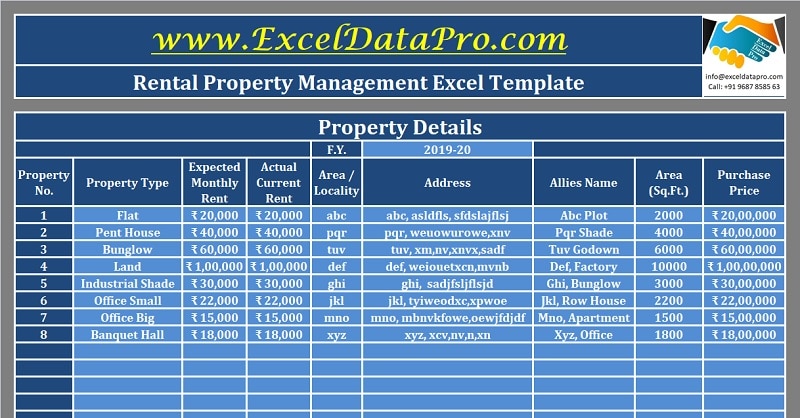

Download Rental Property Management Excel Template Exceldatapro

Rental Property Accounting 101 What Landlords Should Know

How To Calculate Rental Income The Right Way Smartmove

How To Track Your Rental Property Expenses In 2022

Download Rental Home Inspection Checklist Templatelab Com Inspection Checklist Home Inspection Being A Landlord